Let’s now take a look at the right side of the accounting equation. Stockholder’s equity refers to the owner’s(stockholders) investments in the business and earnings. These twocomponents are contributed capital and retained earnings.

What Is the Expanded Accounting Equation?

The Financial Accounting Standards Board had a policy that allowed companies to reduce their tax liability from share-based compensation deductions. This led companies to create what some call the “contentious debit,” to defer tax liability and increase tax expense in a current period. See the article “The contentious debit—seriously” on continuous debt for further discussion of this practice. For example, a company uses $400 worth of utilities in May but is not billed for the usage, or asked to pay for the usage, until June. Even though the company does not have to pay the bill until June, the company owed money for the usage that occurred in May. Therefore, the company must record the usage of electricity, as well as the liability to pay the utility bill, in May.

Module 4: Financial Statements of Business Organizations

Now, let’s say your company generates revenue of $20,000 and incurs expenses worth $5,000 during its first operating period with no withdrawals made by the owner. Examples of supplies (office supplies) include pens, paper, and pencils. At the point they are used, they no longer have an economic value to the organization, and their cost is now an expense to the business.

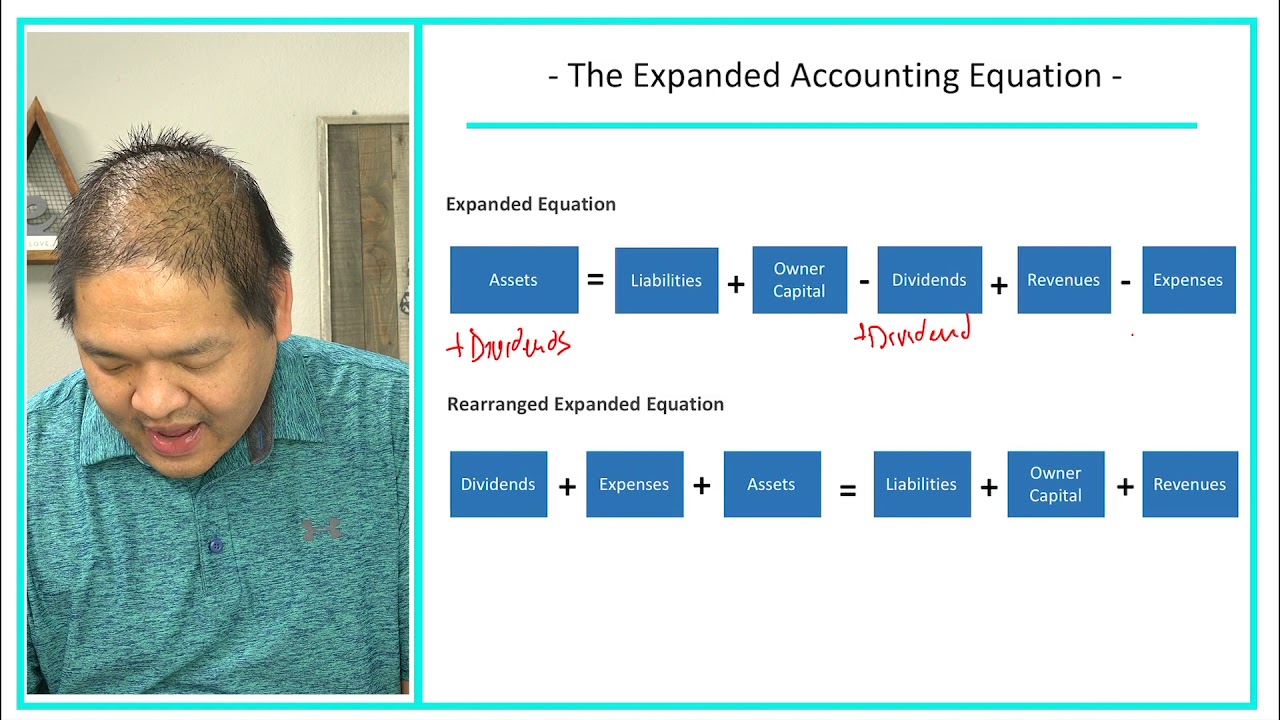

- Equity increases from revenues and owner investments (stock issuances) and decreases from expenses and dividends.

- Anything that can be quickly liquidated into cash is considered cash.

- The expanded accounting equation also demonstrates the relationship between the balance sheet and the income statement by seeing how revenues and expenses flow through into the equity of the company.

Understanding When to Use Your Basic Accounting Equation

This dual-impact mechanism ensures the balancing nature of the equation. Regardless of how complex a transaction might be, the left side (Assets) will always equal the right one (Liabilities + Equity). It can help delineate these essential areas of your finances and ensure your business maintains its economic health while driving growth.

Expanded Accounting Equation vs Basic Accounting Equation

Revenues and expenses are often reported on the balance sheet as “net income.” Revenue refers to the amount of money the company generated in operating its business. Contributed capital, also known as the paid-in capital, refers to the capital provided by the shareholder to the company.

Examples

The key benefit of using the expanded accounting equation is the extra visibility it provides into how the various components of the equity section of the balance sheet change over time. This is useful for outside analysts, who base their stock recommendations on detailed analyses of this type. The equation is especially useful for reviews of changes in the equity accounts of a business. The increases (credits) to common stock and revenues increase equity; whereas the increases (debits) to dividends and expenses decrease equity. Remember, the normal balance of each account (asset, liability, common stock, dividends, revenue, or expense) refers to the side where increases are recorded.

For instance, corporations have stockholders and paid-in capital accounts; where as, partnerships have owner’s contribution and distribution accounts. Thus, all of these entities have a slightly different expanded equation. While the expanded and basic accounting equations have their places in business finance, understanding when to use each is paramount for sound economic decision-making. The expanded accounting equation is an elaborated version of the basic accounting equation, which allows you to get a more detailed look at the financial position of your business. Think of it as going through a buffet spread of your business operations, filled with assets, liabilities, revenues, expenses, and owner’s equity. Naturally, you may be drawn towards some aspects while being cautious about others.

The dividend could be paid with cash or be a distribution of more company stock to current shareholders. An account is a contra account if its normal balance is opposite of the normal balance of the category to which it belongs. The normal balance for the equity category is a credit balance whereas the normal balance for dividends is a debit balance resulting in dividends reducing 5 things you need to know about cleaning business taxes for your llc total equity. Another unique aspect of this particular equation is the component entitled “owner’s draws.” This refers to an owner’s ability to withdraw funds from a company, usually to pay salaries (including his or her own). This occurs most often in what is called a limited liability company, in which the owner is also the shareholder and no outside creditors are involved.

تا سه برابر شارژ هدیه بگیرید

تا سه برابر شارژ هدیه بگیرید